March industrial production figures exceeded expectations (+0.7% vs. +0.5%) and February was revised sharply higher (+1.2% vs. +0.6%). Over the past six months, industrial production has expanded at a solid 5% annualized pace. This is impressive. Industrial production in the Eurozone is still lagging, but nevertheless is still on the mend. Industrial commodity prices are up almost 3% in the past two months to a one-year high, suggesting that global manufacturing activity is doing just fine.

The manufacturing component of industrial production was also strong, but was nevertheless outpaced by gains in utilities (think cold weather). Still, manufacturing production was up at a 3.5% annualized pace over the past six months.

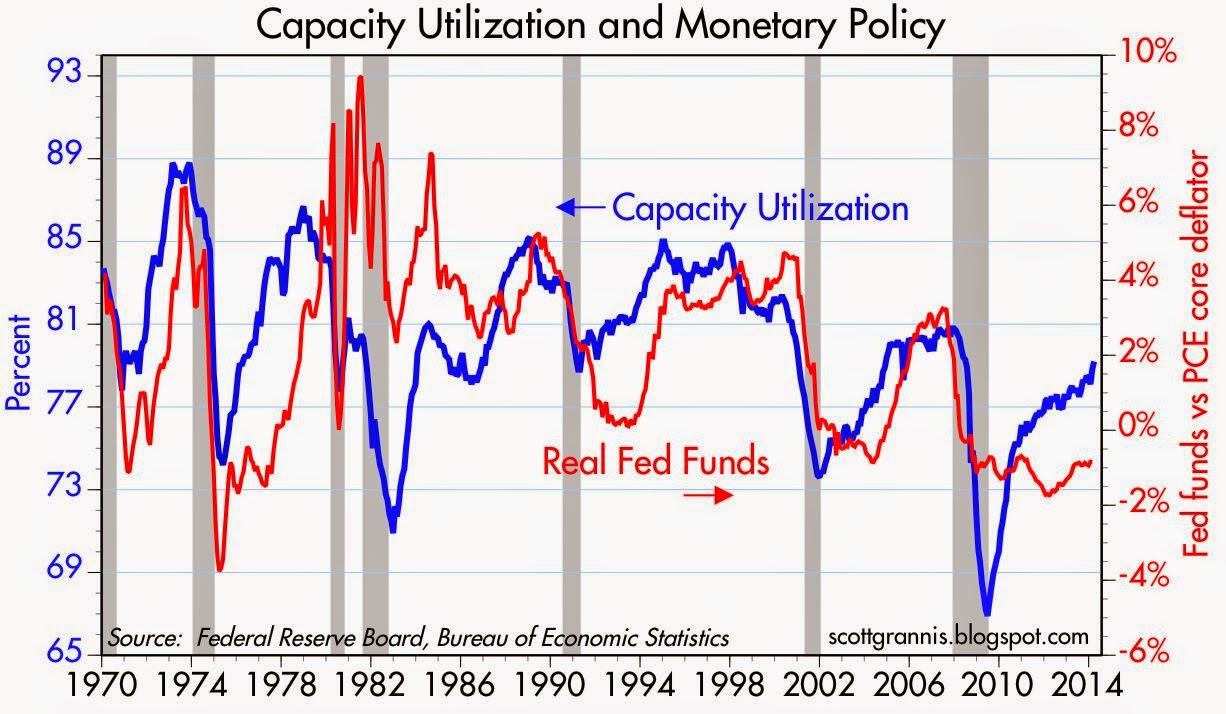

By the Fed's estimates (they can only estimate it, since there is no way to actually measure it), the utilization rate of the nation's productive apparatus rose a good deal more than expected (79.2% vs. 78.7%). Utilization rates are still below their pre-recession high, however, suggesting the economy still has a decent amount of "slack." This is the Fed's justification for keeping real short-term interest rates firmly in negative territory. However, as the chart above shows, gains in capacity utilization of the magnitude that we have seen in the past four years typically would have elicited a substantial Fed tightening by now.

The Fed is still in uncharted territory. It's not a question of whether they will tighten, it's when and by how much. Continued gains like we have seen today will almost certainly tip the scales in favor of sooner rather than later.

Housing starts posted lackluster gains in March, but that is not surprising given the poor weather that persisted. As the chart above shows, builder sentiment is still strong enough to expect housing starts to move higher in the coming months. The housing boom has cooled off in recent months, but it is still underway.

0 Response to "The economy continues to expand"

Posting Komentar