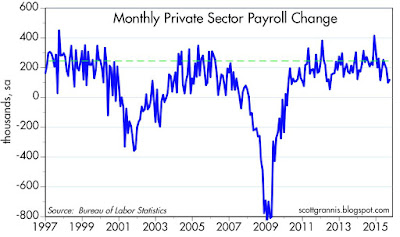

September jobs growth was disappointingly slow, but there's a decent chance that all we're seeing is the typical month-to-month volatility that this series has displayed for many years. This is most likely a temporary statistical slump that will reverse in coming months.

As the chart above shows, ADP's estimates of private sector jobs growth have been much less volatile than the BLS's establishment survey. Since the recovery began in mid-2009 through last month, the two surveys have registered almost identical total jobs growth: BLS 11.974 million, ADP 11.989 million. That's a difference of only 15K jobs, or a mere 12-13 bps. BLS numbers typically overshoot or undershoot the ADP numbers. If this pattern repeats, we should see stronger jobs numbers next month.

In any event, the chart above shows how the monthly swings in jobs growth have at times been significant. The September number was no outlier.

But what we can't ignore is the significant shortfall in the labor force participation rate and the growth of the labor force. If past trends were still in place, we would have at least 10 million more people in the labor force today and many millions more jobs. For a variety of reasons, there are huge numbers of people who have simply "dropped out." Some reasons come quickly to mind: high marginal tax rates, huge regulatory burdens, ongoing growth in transfer payments, and generous welfare benefits. The retirement of the baby boomers is also a factor, but I have trouble believing that it was a coincidence that this kicked in right around the time that federal spending surged in early 2009.

On a year over year basis, jobs growth today is about the same as it has been for the past five years. Earlier this year I thought that there was a chance things might be improving, but I've given up on that hope. We've been stuck in a disappointingly slow-growth economy for the past five years or so, and nothing much has changed of late.

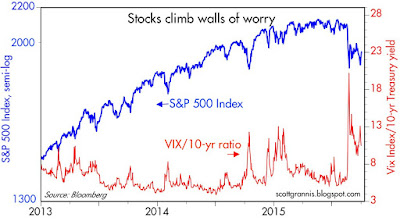

Nevertheless, the fact that the equity market ended up on a positive note today suggests that the market has been priced to rather pessimistic growth assumptions, as I've long argued. Fears, doubts, and uncertainties have weighed heavily on investor sentiment. This is not a bubble market that is vulnerable to popping, this is a market characterized by caution. PE ratios, for example, are only about average, despite the fact that corporate profits are very close to all-time highs relative to GDP. What that tells me is that the market is priced to the expectation that economic growth and corporate profits will be very disappointing. From that perspective, today's jobs report was not a negative surprise.

I don't think it makes any difference whether the Fed postpones liftoff as a result of these numbers or not. (But I would love to see them adopt a more positive attitude and raise rates 25 bps, as that might make the rest of the country a little more optimistic as well.) Whether they launch another round of Quantitative Easing or not wouldn't make much difference either. It should be obvious by now that monetary policy is powerless to stimulate growth. How would another injection of, say, $500 billion in bank reserves (in an exchange for an equal amount of notes and bonds) make a difference to the private sector's willingness to take risk, start up a new company, hire more people, or invest in new productivity-enhancing plant and equipment, when banks are already loaded with $2.5 trillion of excess reserves? The Fed can't print money, only the banks can. And even if the Fed could print money, extra money doesn't necessarily translate into more jobs. More likely, it would just translate into higher prices.

No, the focus needs to shift away from the Fed. They've done all they needed to and all they can do. If we want a healthier economy and more jobs growth, the solution has to come from Washington. We need more growth-friendly polices that make it easier for people to create new businesses and hire more workers. We need lower marginal tax rates (especially on businesses) in order to enhance the after-tax rewards to taking risk and working harder. And we need to slash regulatory burdens to reduce the cost of doing business.

It's my hope that this will be the focus of next year's elections, and that the electorate will respond to the sensible solution—not the populist solution—to our economic woes.

UPDATE: Here's today's version of the "Wall of Worry" chart:

0 Response to "The Fed is powerless to boost jobs growth"

Posting Komentar