In January, 2013, I wrote a post titled "Developments in China explain the end of gold's rise." I speculated that China's spectacular growth over the previous two decades, which included a monster accumulation of foreign exchange reserves and a significant appreciation of the yuan, could have been the driver for the the incredible rise in gold prices. I then noted the slowing in China's accumulation of forex reserves, the slowing in Chinese economic growth, and the beginnings of stabilization of its currency, and asserted that "the boom in gold is over." Shortly thereafter gold suffered a significant decline which I followed up on in a post in April, 2013: "Gold is relinking to commodities."

Here's the short version of how the link between China and gold works: the outstanding stock of gold doesn't change very fast, growing only about 3% a year. But the spectacular growth of the Chinese economy beginning in the mid-1990s created legions of newly prosperous Chinese whose demand for gold pushed gold prices to stratospheric levels. China's economic boom attracted trillions of foreign investment capital, which China's central bank was forced to purchase in order to avoid a dramatic appreciation of the yuan, and to provide solid collateral backing to the soaring money supply needed to accommodate China's spectacular growth. China's explosive growth and new-found riches were what fueled the rise in gold prices. But in recent years the bloom is off the rose.

I think these same dynamics are still in play. Chinese economic growth has definitely slowed, China's forex reserves only increased by 6% in the year ending September, the yuan is unchanged over the past year, and gold prices are down by one-third from their 2011 peak. Here are some updated charts to illustrate what's going on.

China's economy is no longer booming, but 7% growth still ranks as very impressive. China's economy is not collapsing, it's maturing. Even 7% growth is unsustainable for long periods. We ought to expect further slowing in the years to come.

The growth in China's foreign exchange reserves was exponential for many years, but now it's slowed to a trickle. Capital inflows (money wanting to invest in the China boom) have slowed, while outflows (money looking for diversification overseas and money to pay for China's growing appetite for foreign goods and services) have picked up, and the two are coming into balance. That means the BoC doesn't have to buy up capital inflows to keep the currency from appreciating. The yuan is likely to be much more stable going forward.

As it is, the real value of the yuan has appreciated by an astounding 83% in the past 20 years, despite the valiant attempts by the BoC to prevent excessive appreciation. Slower growth and more balanced capital flows mean there is no more need for currency appreciation.

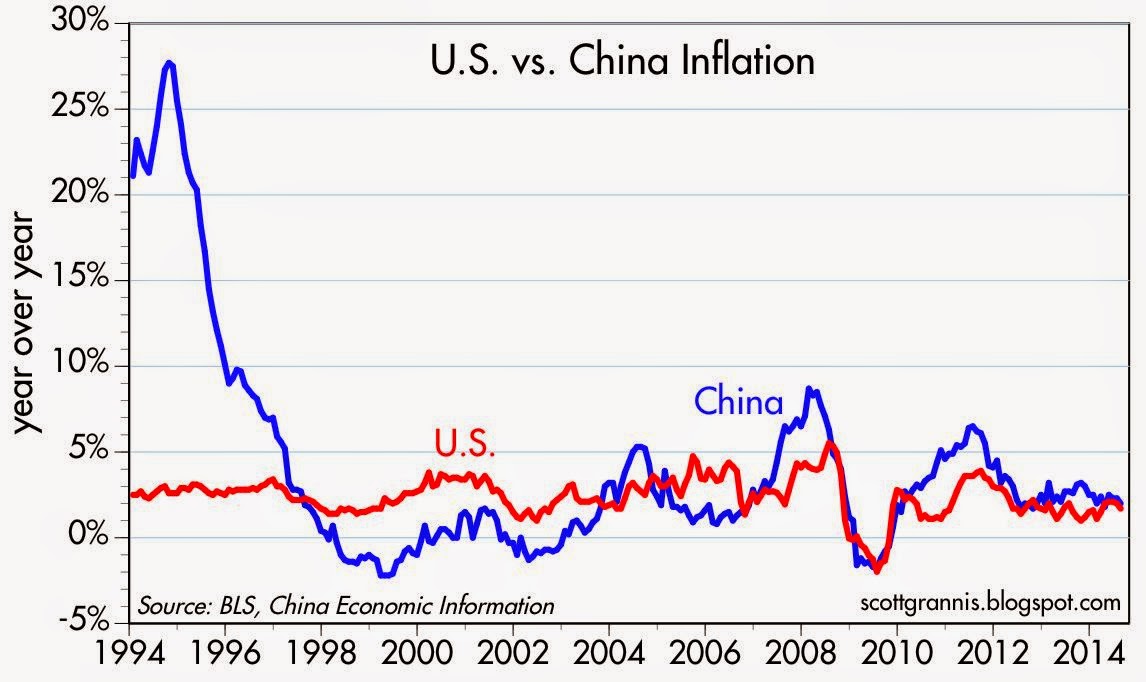

A strong currency and a strong economy have enabled China to enjoy a low rate of inflation for the past 15 years or so. Happily, inflation in the U.S. and China has converged. China's economy has accommodated to its strong currency, and capital flows are coming into balance. On a PPP basis, there is very little pressure for the yuan to keep appreciating.

The spectacular rise in China's forex reserves paralleled the outsized growth of its economy and mirrored the equally spectacular rise in the price of gold. Lots of newly rich Chinese (and Indians, for that matter) were eager to acquire gold for the first time, but that demand appears now to be largely sated.

Gold is still trading well above its long-term average in real terms (I calculated that the average price of gold over the past century in today's dollars is about $650/oz.), so without the onslaught of newly rich Asian buyers its price is coming back down to more closely track those of other commodity prices.

I continue to believe that the downside risks to owning gold are much greater than the upside risks, even though I worry that central banks may inadvertently spark a round of higher inflation in the years to come (as I explained in yesterday's post). If I had to reconcile those two views, I would say that today's elevated real price of gold has effectively priced in a lot of higher inflation in the future.

Selasa, 21 Oktober 2014

0 Response to "How China could explain the decline in gold"

Posting Komentar